TIMSS 6: Revenue Distribution with Fixed Amount & Remainder

Our membership dues are calculated on a dues schedule and can be from $400 to $50,000. We wanted to have the first $400 go to one revenue account and the remainder go to a second account.

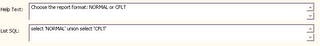

When setting up the revenue distribution you will setup 2 pairs by priority.

- For the $400 revenue pair, the % should be 0, the priority should be 1, and the amount 400.

- For the next revenue pair, the % should be 100, the priority 2, and the amount all 9's.

Applies to: TIMSS6